#SudanUprising: Risks and opportunities as Sudan devalues currency and unifies exchange rate with key industries underperforming

Summary

After protests erupted over Sudan’s dire economic conditions, Sudan’s new cabinet took the controversial decision to devalue the currency, following pressure from international donors and lenders. Currency devaluation attempts to unify Sudan’s exchange rates and cull the negative impact of the black-market currency exchange trade which captures an estimated 90% of Sudan’s hard currency trade. Among the positives of currency devaluation highlighted by new finance minister Jibril Ibrahim include: the increased likelihood of debt relief, stimulating exports, helping Sudan receive revenues through official channels, limiting the smuggling of goods and helping Sudan address the budget deficit, the balance of payments deficit and high rates of inflation. However, further public backlash is expected amid the projected rising prices of goods and services in response to the fall of the Sudanese pound’s value.

A special report on Sudan’s economy by the Financial Times explored issues facing three underperforming yet strategically important industries: agriculture, tourism and gum arabic.

Economic solutions provided for Sudan include: for Hamdok to assertively challenge the ‘hidden market’, a balanced import-export budget and for the government to mitigate the negative impacts of currency devaluation.

Pre-existing economic issues

The Financial Times (26 January) provided insight on Sudan’s economic woes, identifying key issues that are contributing to the long bread and fuel queues caused by the government’s scarcity of hard currency to pay for fuel and wheat imports. According to Sudanese officials, the value of imports is surpassing exports by 50% and the economy is being “starved of foreign exchange since South Sudan seceded in 2011, taking three-quarters of oil reserves.” The hardship is hardship is exacerbated by a plunge in the value of the Sudanese pound on the black market to 300 to the US dollar - the currency used for 90% of Sudanese imports and exports. According to officials, diplomats and economists, while the official exchange rate is 55 Sudanese pounds to the dollar, black-market traders “often loyal to the old regime” are pushing the exchange rate to excess.

Indeed, protests erupted in Sudan “over dire economic conditions” forcing authorities to impose a curfew after civilians took to the streets across Darfur, North Kordofan and Port Sudan (AP, 10 February).

Sudan’s struggling industries

The Financial Times special report on Sudan’s economy shed light on three industries that Sudan is failing to maximise revenues from: agriculture, tourism and gum Arabic.

Agriculture

Andres Schipani’s feature piece exploring issues facing Sudan’s “neglected” agriculture industry argued that “poor infrastructure is holding back development”. Although agriculture provides a living for two-thirds of Sudan’s working population, then-agriculture minister Abdelgadir Turkawi said: “we are only using just about one-third of our arable land. It requires a huge investment to put all land into agricultural production.”

Big projects by DAL group, Sudan’s biggest conglomerate and one of the country’s top private agricultural investors, face problems such as Sudan’s ageing export infrastructure, including its ports. DAL chairman Osama Daoud said agriculture should add value processing by manufacturing and be integrated with animal production (Financial Times, 26 January).

Tourism

Schipani’s feature on the “sluggish” state of Sudanese tourism notes that Sudan’s “greatest archaeological treasure” – the pyramids of the royal city of Meroë is “largely unvisited by outsiders”. Obstacles noted by Schipani include that tourism visas to enter Sudan and official travel permits to roam outside Khartoum are “still cumbersome to obtain”, and western credit cards are rarely accepted (Financial Times, January 26).

Gum Arabic

David Pilling’s feature on Sudan’s gum Arabic industry reports that European producers monopolise the value of one of Sudan’s biggest exports. While Sudan accounts for nearly 70% of the world’s raw exports, 90% of the income from exports of processed gum go to European producers. DAL chairman Osama Daoud said “this market is dominated by companies who have controlled it for years.” He added that: “Sudan has been exporting raw gum arabic for decades and some French and Irish companies make all the money. They are not going to make it easy for us” (Financial Times, January 26).

External pressure to devalue the currency

To resolve the economic situation, Sudan’s new cabinet faced pressure to devalue the currency in order to gain debt relief and international financial support. Sudan’s currency reform delays have been attributed to fear of public reaction, leftist resistance to IMF-led reforms, and the search for a buffer of foreign reserves. However, Sudan’s donors and lenders say unifying the exchange rate would not trigger significant further pressure on the currency or inflation since almost all transactions are already carried out at black market rates (Reuters, 9 February). Indeed, the previous finance minister Hiba Mohammed Ali told Reuters (5 February) that Sudan will decide to float its currency once it has sufficient foreign reserves, in order to prevent “a big jump in the exchange rate.”

Sudan’s currency devaluation

Meeting a demand from foreign donors and the IMF that was delayed for months amid shortages of basic goods and rapid inflation, Sudan’s central bank devalued the currency, announcing a new regime to “unify” official and black-market exchange rates (Reuters, 21 February). Aligning the official and black market rates is central to Sudan’s economic plans, which are hindered by the black market currency trade used by most businesses and ordinary Sudanese continuing to capture most of the hard currency trade. Exchange rate unification had an instant impact, as business on Sudan’s black market slowed and people sold dollars in banks for the first time in years. According to Sudanese officials, the black market, known for its convenience and accessibility, had been handling more than 90% of transactions (Reuters, 22 February).

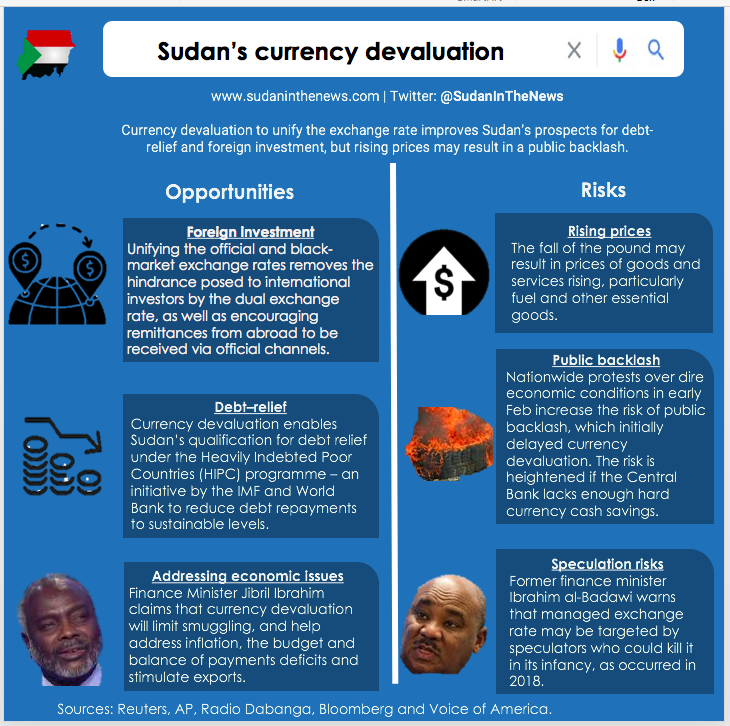

Furthermore, currency devaluation is part of a broader effort to win debt relief and revive Sudan’s struggling economy, although Bloomberg (21 February) also suggest the move “threatens to pile on more hardship in Sudan”. Therefore, currency devaluation presents both opportunities and risks.

Opportunities from currency devaluation

As noted by the US Embassy in Khartoum, black market currency trading culminated in the existence of the dual exchange rate in Sudan which proved a hindrance to local and foreign companies attempting to do business in Sudan (AP, 21 February). As well as attracting foreign investment, Sudan Tribune (21 February) add that currency devaluation would attract remittances from Sudanese abroad, alongside paving the way for normalisation with regional and international financial institutions and ensuring easier access to grant flows and loans.

Finance Minister Ibrahim said the move would also stimulate exports, help Sudan receive revenues through official channels and enable Sudan’s qualification for debt relief under the Heavily Indebted Poor Countries (HIPC) Initiative (Radio Dabanga, 22 February). Ibrahim further claimed that unifying the exchange rate would limit the smuggling of goods and help Sudan address the budget deficit, the balance of payments deficit and high rates of inflation (Sudan Tribune, 22 February).

Khartoum-based economist Abubakr Omar said the step is necessary to reform the Sudanese economy, as it would enable Sudan’s involvement in the international economy by utilising its natural resources. In addition, analyst Abubakr Mohamed predicts that the initial negative impact of currency devaluation will be small as the official economy is not controlled by the market (Voice of America, 22 February). Nonetheless, even Finance Minister Jibril Ibrahim acknowledges that the move will lead to a “soaring of prices” (Bloomberg, 21 February).

Risks from currency devaluation

AP (21 February) note that the sharp devaluation “could provoke a popular backlash as the price of goods and services rise in response to the fall of the pound’s value and possible hike in the price of fuel and other essential goods”. Economist Waleed Alnoor argued that devaluation is “risky” and “will have a severely negative impact on people and the economy” if the central bank does not have enough cash savings of the hard currency, adding that the greatest impact will be on the middle-class and low income people (Voice of America, 22 February). Furthermore, former finance minister Ibrahim al-Badawi criticsed the managed exchange rate system, warning that it would pose an ideal target for speculators who could kill it in its early stages, as happened during the era of the previous regime in 2018 (Radio Dabanga, 22 February).

Solutions

Exposing the hidden market

Arguing that over 80% of Sudan’s money is circulating outside of authorised bodies, Madiha Abdallah, the editor of the Communist Party’s al-Midan newspaper (3 February), calls for Prime Minister Hamdok to adopt a more confrontational approach to the “secret causes of the economic crisis”. Practical steps suggested by Abdallah include: exposing all the economic institutions and interest networks associated with the mechanisms of the hidden market, alongside the sidelining by some government bodies of government revenue, as well as countering tax evasions, smuggling and foreign exchange brokers. Abdallah concludes that “confrontation should include the naming of those interest groups, most of which had been built during the rule of darkness of the defunct regime.”

Mitigating the negative impacts of currency devaluation

Attributing the rapid fall of the Sudanese Pound to the formation of the new government and speculation by currency dealers, economic expert Dr. Sidgi Kaballo suggests that the government take urgent measures to reduce the demand for the Dollar, including preventing the import of luxury goods. He further called for public companies to take over export operations, and that the livestock export trade must be “taken away from the monopoly of the military establishment” (Radio Dabanga, 17 February).

Balanced budget

Following Sudan’s currency devaluation, former finance minister Ibrahim al-Badawi called for the prevention of “random borrowing” from the Central Bank of Sudan, warning that doing so may lead to a budget deficit, an explosive inflation, and an economic collapse. The government should also provide foreign currencies to the private sector so that companies can import strategic goods, argued al-Badawi (Radio Dabanga, 22 February).